Navigating uncertainty in portfolio management can feel like juggling flaming swords—except the swords are strategic initiatives, and the risk of failure is real. Traditional portfolio approaches often fail because they try to predict everything upfront, which sounds great if you’ve got a crystal ball. The reality? You don’t. That’s why applying Agile and Lean principles to portfolio management works so well. It’s about embracing uncertainty, validating ideas, and adjusting on the fly—all while staying aligned with broader company goals.

One approach that’s gained a lot of traction for tackling uncertainty head-on is SAFe’s (Scaled Agile Framework) FRAPID model, which leverages the Epic Hypothesis Statement. Now, that might sound like jargon, but underneath it, there’s a simple idea: don’t just assume your latest big idea is going to work. Instead, you treat it like an experiment.

An Epic Hypothesis Statement is essentially a way to frame big portfolio-level initiatives as testable theories rather than guarantees. You start by stating the business outcome you expect (i.e., increased customer acquisition), followed by indicators that would signal success or failure. This isn’t about getting it perfectly right the first time but about recognizing that the only way to reduce risk is by learning fast. In reality, it’s about responding to evidence as it emerges, much like Agile teams adapt their plans based on sprint results.

So, let’s break this down. Say your organization is rolling out a new feature designed to streamline customer onboarding. In the old way of doing things, you’d put months of planning into this, with the expectation that customers would flock to the feature on day one. But with Agile, instead of committing fully upfront, you test parts of that idea: maybe you roll it out to a small customer segment and gather feedback early. Your hypothesis might be, “We believe this feature will reduce dropout rates by 15% during onboarding,” and you measure that over a few iterations.

This is where the FRAPID model—an acronym for Funnel, Review, Analyze, Prioritize, Implement, and Done—really drives home its value. Instead of grinding through months of development before assessing any tangible impact, you get insight quickly. You funnel your ideas down to those worth experimenting with, review their potential risk, analyze feasibility, prioritize the best opportunities, and start implementing in small chunks—the Agile way. If that onboarding feature doesn’t hit the 15% reduction goal? It’s not a failure. It’s a signal to pivot, adjust, and see what can be improved. The failure here is actually failing to adjust when that early feedback rolls in.

Agile portfolio management, with hypotheses front and center, creates this interplay between thinking big and pivoting small. It reduces the risk of pouring resources into initiatives that ultimately don’t align with strategic themes. Everyone involved has a shared understanding that some things will work, some won’t—and that it’s not only okay but expected that value delivery happens iteratively. This approach lets you map your portfolio back to high-level goals without betting the farm on a single, fixed idea that’s still shrouded in unknowns.

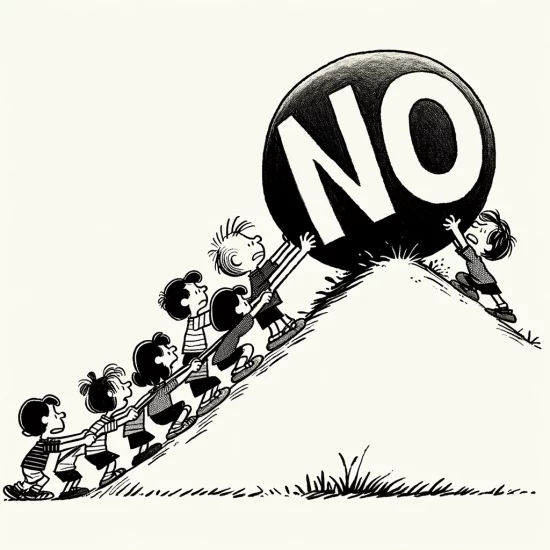

Of course, the cultural shift required to move toward this hypothesis-driven model isn’t always easy, especially at the portfolio level. You’ll likely encounter hesitation. After all, leadership is used to defining clear deliverables with set deadlines. But the beauty of this Agile mindset is how it reframes “failure.” Suddenly, learning from early results becomes part of the success strategy—because the real failure would be blindly pushing forward with an initiative that simply doesn’t deliver tangible value. That’s a big mindset change, and it’s critical to lean into it.

Another advantage of using the Epic Hypothesis Statement in your portfolio management is how it fosters collaboration between teams and leadership. Because everything gets framed as an experiment, it naturally opens regular communication channels. Teams aren’t just handed down a plan—they’re active participants in shaping and refining it, contributing practical insights from the ground level that otherwise might be lost in the larger corporate shuffle.

Testing assumptions at the portfolio level also keeps your initiatives grounded in real-world data. You’ve got constant feedback flowing in from front-line teams, who are the ones dealing directly with customers, systems, and markets. And that feedback feeds right back into your Agile portfolio management, creating a continuous loop of learning, testing, and adjusting.

And while all of this provides flexibility, there’s still structure. Initiatives don’t just languish indefinitely in that dark, liminal space of “let’s wait and see.” The FRAPID model ensures regular checkpoints are in place to assess whether you’re moving in the right direction or if it’s time to pivot, kill the initiative, or double down.

When you combine these Agile portfolio practices with Lean principles—the constant pursuit of delivering value and reducing waste—you avoid the all-too-common trap of pursuing big, shiny projects that look good on paper but deliver little in real-world impact.

Of course, even with the best laid-out frameworks, challenges will always arise. A common hurdle when applying the Epic Hypothesis approach is organizational impatience. You might put your hypothesis to the test, gather feedback, and realize your initial assumptions missed the mark. At that moment, the impulse from leadership may be to drop the initiative entirely, rather than lean into new insights and iterate further. This mindset is a tough one to break, especially when leadership anticipates quick wins from portfolio initiatives.

But this is where the beauty of Agile really comes into play. Agile—and by extension, Lean Portfolio Management—isn’t about rushing to finish the first iteration. It’s about being disciplined in learning and adjusting continuously. Feedback isn’t meant to rubber-stamp a project but to guide it. When you adopt that mindset, the process gets easier to trust. Instead of labeling something a “failure,” it becomes an opportunity to pivot smarter.

Now, let’s look at a typical scenario: an organization rolls out a new product with a lot riding on it. The launch doesn’t quite hit the adoption numbers expected. A more traditional company might force through additional marketing or sales tactics without reevaluating the core problem. Agile-driven portfolios, though, allow you to reframe this under the Epic Hypothesis lens by asking, “What assumptions were we making here? What data have we gathered from the initial rollout that could shape our next steps?” Maybe the issue isn’t the product itself but how it’s positioned in the market.

In this sense, Agile portfolio management isn’t just reactive—it’s proactive risk management. You have the freedom to course-correct as you go, breaking down massive strategic goals into bite-sized initiatives that can adapt based on real-world customers, teams, and results. The more feedback loops you create, the better your chances of validating whether an idea should get scaled out or tapped out.

But let’s be clear—this method works best when it’s backed by solid governance structures. I’m not talking about adding layers of bureaucracy here. In Lean Portfolio Management, governance is about creating consistent standards while still giving teams the freedom they need to operate with agility. It ensures hypotheses are vetted carefully, experiments have measurable outcomes, and everyone knows what defines success or failure before diving in. If your governance is clear, Agile portfolios can strike that balance between strategic alignment and empowering teams to innovate responsibly.

Another interesting aspect of hypothesis-driven portfolios is how they foster cross-team collaboration. When you make an initiative testable and measurable, it’s no longer just a responsibility of one Agile team; it’s a shared challenge. Marketing, development, sales, and customer support all have skin in the game because they’re essentially all part of testing and validating that hypothesis. Everyone approaches it as a cooperative effort to determine if the organization is on the right track.

Take, for example, a cross-functional effort to improve customer retention. You might hypothesize that enhancing user onboarding through personalized tutorials will boost retention by 10% over the next quarter. Now, the product team is building the tutorials, the sales team is collecting feedback on their usability, and customer support is fielding the incoming questions. This constant pooling of insights from multiple departments gives you a multidimensional view that one department alone might never spot. It not only decreases siloes but helps teams work together toward a shared, measurable outcome.

Another often-overlooked benefit of Agile-driven portfolios is how well they manage distractions. We’ve all been in environments where shiny objects chase down teams: brand-new initiatives sprout up out of seemingly nowhere because someone had an epiphany during a meeting and wants to shift focus. Agile, in general, offers teams a buffer against this kind of chaos, but the Epic Hypothesis approach blocks it at a portfolio level. Instead of slinging a new initiative into the schedule based on intuition alone, you return to the questioning process: Does this new idea align with our strategic themes? How will we test that this is truly valuable for the business? By reframing these “good ideas” as hypotheses to be validated, you subject them to the same rigor as existing efforts, preventing the team from veering off-course into distractions.

At the end of the day, Agile and Lean principles are really about evolving with intent. Uncertainty is always part of the equation—the marketplace changes, customer needs shift, and what seemed like a sure bet might crumble under early testing. But what sets Agile portfolios apart is the deliberate, adaptive nature of their approach. Hypothesis-driven development allows organizations to surf the waves of uncertainty rather than be overwhelmed by them. It’s not a foolproof way to guarantee success, but it’s a method designed to foster learning early—and often—in your portfolio management.

Managing portfolio uncertainty doesn’t mean avoiding risk altogether. It means approaching big decisions with a mindset that understands the real unknowns. Instead of committing to a rigid path, you’re prepared to experiment, validate, and pivot. By sticking with an Epic Hypothesis approach, your organization can form a symbiosis between strategic alignment and the flexibility Agile demands. It gives you the tools not just to adjust to change, but to anticipate and even welcome it.

This mix of structure and flexibility creates an environment where portfolios aren’t static roadmaps but living, breathing plans. Plans that evolve, adapt, and, most importantly, deliver value based on empirical results instead of gut instincts. In the Agile world, that’s the closest thing to a sure bet.